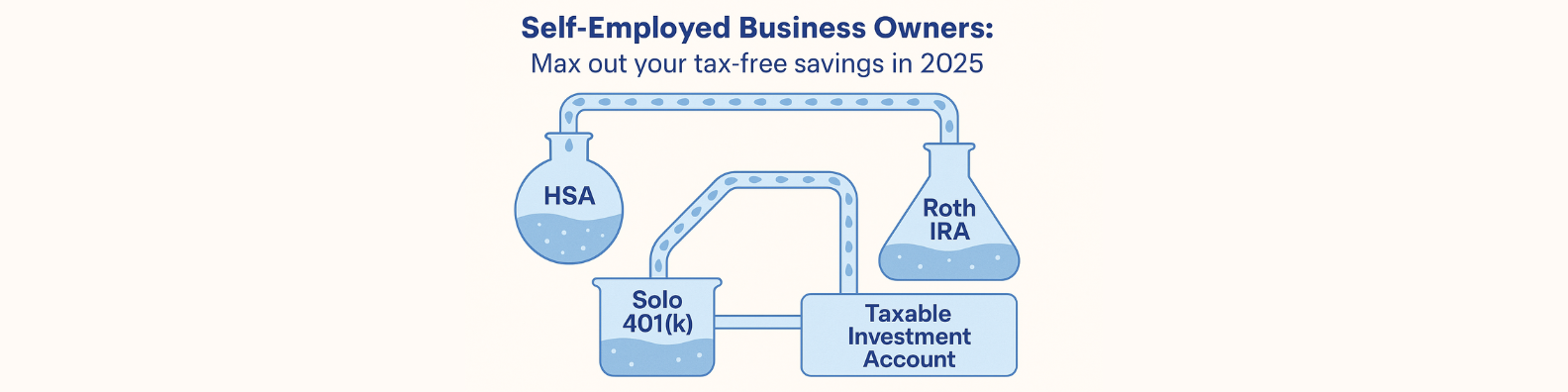

Maximize Your Tax-Free Savings in 2025

A Guide for Self-Employed Professionals & Business Owners

When you’re self-employed — whether you’re a YouTuber, dentist, Amazon seller, TikToker, or freelancer — you don’t just run your own business. You also manage your own retirement, healthcare, and financial future. The good news? 2025 offers multiple tax-advantaged savings options that can significantly lower your tax bill and grow your wealth.

Here’s how to make the most of the tools available:

🔬 Health Savings Account (HSA)

If you’re enrolled in a high-deductible health plan, an HSA is the most tax-advantaged account available. You get:

- Tax-deductible contributions

- Tax-free growth

- Tax-free withdrawals for qualified medical expenses

For 2025, you can contribute up to $4,150 (individual) or $8,300 (family) — plus a $1,000 catch-up if you’re 55+.

Bonus: After age 65, you can use HSA funds for anything (non-medical expenses taxed like a traditional IRA).

🧪 Solo 401(k)

Also known as an Individual 401(k), this retirement account is made for sole proprietors and single-member businesses.

You can contribute as both employee and employer, with limits up to $69,000 in 2025 (or more if you’re over 50).

- Contributions reduce your taxable income now

- Growth is tax-deferred

- Roth Solo 401(k) options may be available for future tax-free withdrawals

Ideal for: Shopify store owners, dentists, equipment rental businesses, and other profitable solo ventures.

🧬 Roth IRA

Roth IRAs allow you to:

- Pay taxes now

- Let your investments grow tax-free

- Withdraw tax-free in retirement

In 2025, you can contribute up to $7,000 (or $8,000 if you’re 50+), subject to income limits. Even if you’re over the limit, a “Backdoor Roth IRA” strategy may be possible.

🎓 529 Plans

Saving for a child’s (or your own) education? A 529 plan allows your investments to grow tax-free, and withdrawals are tax-free when used for qualified education expenses (including some K–12, vocational, and apprenticeship costs).

Pro tip: Some states also offer state tax deductions on contributions.

💼 Taxable Investment Accounts

While not tax-advantaged, taxable brokerage accounts offer:

- Unlimited contribution flexibility

- No income limits

- Access to lower long-term capital gains rates

Once you’ve maxed out your HSA, Solo 401(k), Roth IRA, and 529 — your taxable account becomes your next-best tool for long-term investing.

Why Strategy Matters

With so many options, the real challenge is choosing the right mix — and doing it in a way that lowers your tax bill today and builds wealth for tomorrow.

At Velin & Associates, Inc., we help:

- Self-employed creators choose the right retirement plan

- Shopify and Amazon sellers reduce taxable income

- Dentists and medical professionals align investments with business goals

- Local trades and service professionals find hidden tax-saving opportunities

Example Strategy

Let’s say you’re a TikToker or Amazon seller earning $150K annually. A smart plan might look like:

- $8,300 into an HSA

- $40,000+ into a Solo 401(k)

- $6,500 into a Roth IRA

- $5,000 into a 529 for your child

- The rest into a taxable brokerage account

With proper planning, you’ve lowered your taxable income, invested for the future, and gained flexibility.

Need Help Choosing the Right Accounts?

We specialize in tax planning for self-employed professionals, creators, and small business owners. Don’t let unused opportunities cost you thousands in taxes.

Let us help you build a tax-smart savings strategy tailored to your income, goals, and business type.

Contact Velin & Associates, Inc. Today:

📍 8159 Santa Monica Blvd STE 198/200, West Hollywood, CA 90046

📞 323-902-1000

📧 dmitriy@losangelescpa.org

🌐 www.losangelescpa.org

Our firm provides the information in this e-newsletter for general guidance only, and does not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional tax, accounting, legal, or other competent advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation. Tax articles in this e-newsletter are not intended to be used, and cannot be used by any taxpayer, for the purpose of avoiding accuracy-related penalties that may be imposed on the taxpayer. The information is provided "as is," with no assurance or guarantee of completeness, accuracy, or timeliness of the information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.